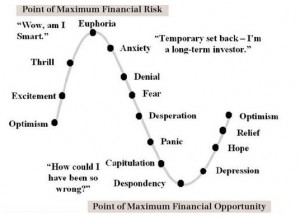

Came across this very interesting Zig Zag Chart……I say there’s some more pain…so we should be moving towards panic on the downside….mark… the recovery will not be as pronounced….in that a Sensex of 21000 that was touched in the first month in 2008 is now not even visible on the horizon on any recovery from despondency

Reiterating the previous Blog….look for scavenger prices….lifeless prices….thats the point of Maximum Financial Opportunity….The Market as a whole yet has to fall towards such prices…though some scrips have had such a pronounced fall that the lows they fell to could be viewed as scavenger prices….Sesa Goa dropped like a closed parachute inside days from ex bonus ex split levels of Rs 175 to lows of Rs 99/100 four trading days ago as FIIs who held 23% of the equity began exiting to repatriate urgent liquidity to their sinking mothers back in USA …It’s bounced back to Rs 126 showing that India has some matured value Buyers who will not miss scavenger prices even if the overall sentiment is bleak and weak

So prepare your Stock Selection Lists and assess what should be the Scavenger Price range for each selection……this would be your entry point…this would vary from person to person based on risk profile and valuation assumptions…For Example IFCI is looking like a Vulture Pick to some at Rs 38/39….My Scavenger Price Range is Rs 25 to Rs 29….buying at distress price and not stress price will give maximum gains…and believe me distress time is coming up ahead