So you think with the buoyancy in US Indices so far in 2012,Hedge Funds are having a Good time again ! ~ Think Again !

I’ve held that Aggression is an extremely Risky Stance given the weak macro global headwinds that yet prevail

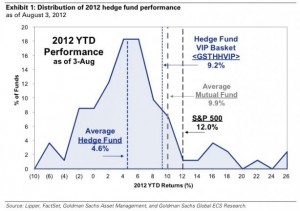

Joe Weisenthal just posted an interesting and revealing study in Business Insider that just 11% of Hedge Funds have outperformed the buoyant S & P as of August 3,2012 this year in 2012.This has been monitored by Goldman Sach’s Hedge Fund Trend Monitor by Amanda Sneider

This means that just 1 of 9 Hedge Funds have outperformed the S & P ! ~ that’s a rotten statistic ! great actually as it shows up the huge risks in aggressive play in times like these

20% of Hedge Funds have actually made a loss while the S & P has moved up by 12% ~ The Hedge funds average return is just 4.6%

Apple is the most popular Stock held followed by Google with Exxon Mobile being the stock most shorted

Consumer Discretionary and Information technology are favourite Sectors

A Warning,perhaps, for Indian Market Bravehearts !

Perhaps you should hedge by buying September Puts just before we begin September !

Cheers !