IndiGo has had a brilliant listing this morning at 10 am opening at Rs 856 on BSE and racing to a high of Rs 898 and now is at Rs 860 levels at 10.20 am.The IPO Price was Rs 765

Why this Premium on Listing !?

Go through my IPO Note below to get some sense and wonder why Retail Investors missed out and why many ridiculed the Pricing and the over liberal Dividends

October 29,2015

SCRIP SCAN

FLY INDIGO !

IPO of InterGlobe Aviation Ltd (IndiGo)

Book Building Price Band : Rs 700 to Rs 765

IPO refuelling the IndiGo Fleet for Operations & Expansion

- IPO refuelling the IndiGo Fleet for Operations & Expansion

Profitable Operations in 7 of 9 Operating Years as a Low Cost Carrier & Bumper Profits on significantly lower Aviation Turbine Fuel Prices in ongoing FY 16 indicate an Earnings Multiple of just 11 on IPO Top Range Pricing of Rs 765

+

Scale Potential being tapped with Huge Expansion with current 97 Airbus Fleet to be expanded to over 527 (Orders placed) over the next decade

Major Risk

Listing Gains may not be available as :

Indigo drained of all Networth by Dividends to show a negative Networth on June 30,2015 ! + Offer for Sale Component is huge at @ Rs 1750 crs (nearly 60% of Issue Size) and nearly all shareholders are offloading part of holding

Thus Promoter Mindset perceived to be Greedy by Retail Investors who tend to invest more on emotion & sentiment than on pure reason and thus response has been tepid from them

“Why should we pay a high IPO Pricing of Rs 765 just for Potential & Promoter Pocket. Moreover Bumper Profits & Over the Top Liberal Dividend Distribution Practice & Policy may not sustain into the Future!”

|

IPO Opened on |

Tuesday, Oct 27, 2015 | |

|

IPO Closes Today |

Thursday, Oct 29, 2015 | |

|

IPO Type |

100% Book Building | |

|

Equity Shares Offered |

Fresh shares ~ 16.6-18.2 Million shares (worth Rs 1272 Crs) Offer For Sale (OFS) ~ 22.8 Million shares being part of holdings from nearly all existing shareholders | |

|

Face Value of Shares |

Rs 10 | |

|

Price Band |

Rs 700 – Rs 765 Per Equity Share | |

|

Issue Size |

Rs 3018 Crs @ Rs 765 per share | |

|

Listing on |

BSE, NSE | |

|

Bid Lot |

15 Equity shares and multiple of 15 Equity Shares | |

|

Global Book Running Lead Manager |

Citigroup Global Markets India Private Limited, J.P. Morgan India Private Limited, Morgan Stanley India Company Private Limited | |

|

Book Running Lead Managers |

Kotak Mahindra Capital Company Limited | |

|

Object of the issue |

1. Rs 1165 Crs towards retirement of certain outstanding lease liabilities and consequent acquisition of aircraft | |

| 2.Rs 33 Crs for purchase of ground support equipment for airline operations; and | ||

| 3. General corporate purposes | ||

| 4. To receive the benefits of listing of the Equity Shares on the Stock Exchange | ||

|

QIB’s |

50% of Net Issue Rs 1512 Crs (including Anchor) at upper band | |

|

NIB’s |

15% of Net Issue Rs 454 Crs at upper band | |

|

Retail (upto Rs 200000) |

35% of Net Issue Rs 1059 Crs at upper band |

OVERVIEW

InterGlobe Aviation is the company that owns & operates the Low Cost Carrier IndiGo Airlines. The airlines commenced operations in August 2006 and is now one of the largest players in the domestic airline space with the largest market share that’s fast closing in on 40%. It ranked seventh in terms of largest low-cost carrier globally in seat capacity in 2014, according to CAPA Centre for Aviation . At the end of August 2015, the airline had a fleet of 97 aircraft.

It has an order book of 180 A320 neo (new engine option) aircraft and expects to take delivery of 15 additional aircraft, including nine A320 neos by March 31, 2016. According to Airbus, A320 neo aircraft are expected to consume up to 15% less fuel than current generation A320 aircraft without shark-lets, which will further reduce fuel consumption per flight.

Indigo has also recently placed an order for 250 new Airbus aircrafts in 2015 which are scheduled for delivery between 2018 to 2026.

It is on track to more than double current fleet size of 97 to 200 by 2021 and cross 500 in 2026.

BUSINESS MODEL

IndiGo is a low cost carrier ( LCC) and focuses primarily on the domestic Indian air travel market. It employs a single type of airframe and engine within its current fleet from Airbus which helps reduce expenses related to maintenance, spare parts, operation, crew training and labour, and managing crew rosters.

Its aircraft utilization in block hours was 11.4 hours per day per aircraft in FY14, which was among the highest of any airline in India, according to CAPA. High aircraft utilization rates are maintained by keeping a low turnaround time between flights. Moreover, the company operates a point-to-point route network with no interlining or code-sharing with other airlines for passenger traffic, which further helps to reduce turnaround time.

As of April 30, 2015 Indigo operated scheduled services to 33 airports in India, with a maximum of 593 domestic flights per day. It plans to add two to three cities every year. In 2015, it added Dimapur and Udaipur to its list.

The average on time performance of IndiGo was 86.7% in FY 2015 and 88.2% in FY 2014. It had operational reliability ratings of 99.95% in FY 2015 and 99.94% in FY 2014, according to Airbus.

IndiGo also maintains low distribution costs by increasing direct sales via website, airport, call centre and mobile app and scaling down commissions paid to online and traditional travel agents.

Unlike its competitors, IndiGo does not offer a frequent flyer program, free lounges or include food and beverages in ticket price for non-corporate passengers. This further reduces its cost base.

Promoters:

Mr. Rahul Bhatia & Mr Rakesh Gangwal ~ Both are Non-executive Directors

Whole Time Directors

Mr. Kapil Bhatia is the Chairman and Managing Director

Mr Aditya Ghosh is the President and Whole Time Director

PRE IPO SHAREHOLDING

Pre IPO there are 18 shareholders of IndiGo of which 10 belong to the promoter and promoter group who hold 94% of the Equity. Top 10 shareholders hold 99% of the Equity.

|

Promoter Shareholding Pattern |

|||||

|

Sr No. |

Name of the Shareholder |

Pre-Issue |

Post – Issue |

||

|

No. Of Equity Shares |

% Stake |

No. Of Equity Shares |

% Stake |

||

|

Promoter |

|||||

|

1 |

Mr. Rahul Bhatia |

3046000 |

0.89 |

40000 |

0.01 |

|

2 |

InterGlobe Enterprises |

156940000 |

45.67 |

153649581 |

42.65 |

|

3 |

Mr. Rakesh Gangwal |

63602000 |

18.51 |

60862000 |

16.89 |

|

4 |

Acquire Services |

10000 |

0.00 |

10000 |

0.00 |

|

Promoter Group |

|||||

|

5 |

Mr. Kapil Bhatia |

50000 |

0.01 |

50000 |

0.01 |

|

6 |

Ms. Rohini Bhatia |

10000 |

0.00 |

10000 |

0.00 |

|

7 |

Dr. Asha Mukherjee |

1499000 |

0.44 |

1349100 |

0.37 |

|

8 |

Ms. Shobha Gangwal |

36022000 |

10.48 |

34852000 |

9.67 |

|

9 |

The Chinkerpoo Family Trust (Trustee: Ms. Shobha Gangwal & J. P. Morgan Trust Company of Delaware) |

58800000 |

17.11 |

56380000 |

15.65 |

|

10 |

IGE (Mauritius) Private Limited |

3240000 |

0.94 |

3240000 |

0.90 |

|

Total |

323219000 |

94.05 |

310442681 |

86 |

|

SHAREHOLDERS PARTICIPATING IN THE OFFER FOR SALE IN THE IPO

Of the 18 Shareholders in IndiGo,13 are offering part of their holding for sale in the IPO.Of these 13,6 are Promoters

There are Five shareholders not participating in the Offer For Sale of which Four have small holdings while one Employee, Mr Riyaz Haider Peer Mohamed holds 5,110,000 equity shares (1.49% of Pre-Issue Equity). He is the Chief Aircraft Acquisition & Financing Officer of the Company. He has availed a loan from the Co-founder Mr Rahul Bhatia. The loan repayment obligations are secured by a pledge over 50% of the Equity Shares held by him. 2555000 Equity Shares held by Mr. Riyaz Haider Peer Mohamed are pledged in favour of Mr. Rahul Bhatia and on the remaining there is a Right of First Refusal. Loan repayment to Mr Bhatia is due in 2016.Thus his holding is not/cannot be offered for sale in the IPO

InterGlobe Enterprises, the promoter group entity which owns nearly half of IndiGo,is wholly owned by Co Founder Mr Rahul Bhatia and Family.At Rs 765 his Group will received @ Rs 486 crs for the Offered Shares while Mr Rakesh Gangwal and Family will receive @ Rs 484 crs

|

22.87 m shares Offered For Sale in the IPO by Following Shareholders |

||

|

Sr No. |

Name of the Shareholder |

No. Of Equity Shares |

|

1 |

Mr. Rahul Bhatia |

3060000 |

|

2 |

Mr. Rakesh Gangwal |

2740000 |

|

3 |

InterGlobe Enterprises Limited |

3290419 |

|

4 |

Ms. Shobha Gangwal |

1170000 |

|

5 |

Dr. Asha Mukherjee |

149900 |

|

6 |

The Chinkerpoo Family Trust (Trustee: Ms. Shobha Gangwal & J. P. Morgan Trust Company of Delaware) |

2420000 |

|

7 |

Mr. Newton Bruce Ashby |

6012000 |

|

8 |

Mr. Steven Eugene Harfst |

1442000 |

|

9 |

Mr. Shakti Swarup Lumba |

84000 |

|

10 |

Mr. Sanjay Kumar |

100200 |

|

11 |

Mr. Anil Chanana |

601200 |

|

12 |

Mr. Kunal Chanana |

300600 |

|

13 |

Mr. Paul Carl Schorr, IV (nominee of G5 Investments) |

1503000 |

|

Particulars |

FY 11 |

FY 12 |

FY 13 |

FY 14 |

FY 15 |

Q1FY 16 |

|

Share Capital |

34.37 |

34.37 |

34.37 |

34.37 |

34.37 |

343.72 |

|

Networth |

103 |

243 |

389 |

422 |

426 |

-139 |

|

Total Debt |

861 |

936 |

1698 |

3081 |

3588 |

3567 |

|

Net Sales |

3833 |

5565 |

9203 |

11117 |

13925 |

4212 |

|

Other Income |

111 |

144 |

237 |

316 |

384 |

106 |

|

PAT |

579 |

141 |

783 |

474 |

1296 |

640 |

|

Book Value (Rs) |

30 |

71 |

113 |

123 |

124 |

-4 |

|

EPS (Rs) |

18.88 |

4.58 |

25.52 |

15.45 |

42.2 |

20.64 |

|

Dividend |

490 |

– |

549 |

378 |

1080 |

1003 |

|

Dividend Payout (%) |

85 |

– |

70 |

80 |

83 |

157 |

FINANCIAL TRENDS OVER FIVE YEARS ~ Amount in Rs Crs

Source: The Flying Engineer

PEER COMPARISON ~ Amt in Rs Crs ~* As of June 30, 2015,rest all March 31,2015

|

Particulars |

Indigo |

SpiceJet |

Jet Airways + Jet Lite |

|

Equity Capital |

343.72* |

599.45 |

113.6 |

|

Networth |

-139* |

-1019 |

-6325 |

|

Total Revenue |

14309 |

5463 |

21537 |

|

Net Profit |

1296 |

-687 |

-2101 |

|

Total Assets |

10774 |

497 |

6161 |

|

Long Term Debt |

3588 |

1120 |

6607 |

|

EPS(Rs) |

42.2 |

-12.28 |

-184.64 |

|

BV(Rs) |

-4* |

-17 |

-557 |

|

EV |

25500 |

3924 |

12718 |

|

EBITAR |

3831 |

468 |

1814 |

|

EV/Sales |

1.78 |

0.72 |

0.59 |

|

EV/EBITDAR |

6.66 |

8.38 |

7.01 |

|

Revenue/ASK |

3.7 |

3.8 |

4.13 |

|

Net Debt-Equity |

-25.82 |

-1.1 |

-1.04 |

|

EBITDAR Margin (%) |

27 |

9 |

8 |

|

Load Factor (RPKM/ASKM) (%) |

83 |

81 |

74 |

|

No Of Airplanes |

97 |

35 |

115 |

|

Avg Fleet Age (Years) |

3.1 |

3.8 |

5.8 |

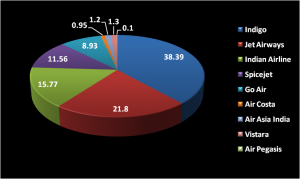

Market share of Domestic Airlines as of Q1 FY16

A survey all over India by “Trip Advisor” following is the findings on scale of 100 percent:

|

Factors\Name |

Indigo |

Jet Airways |

Air India |

Go Air |

Jet Connect |

SpiceJet |

|

Value for money |

44.4 |

13.2 |

6.8 |

2 |

1.1 |

6.3 |

|

Services- food and entertainment |

47.2 |

47.2 |

32.2 |

1.1 |

2.2 |

6.9 |

|

Cabin crew appearance |

35.8 |

46.5 |

3.6 |

2.7 |

1.7 |

9.7 |

|

Cabin crew quality-Service |

36.1 |

44.9 |

5.6 |

2.7 |

1.6 |

9.1 |

|

On Time performance |

65.5 |

18.3 |

6.8 |

2 |

1.1 |

6.3 |

|

Landing & Take off quality |

39.7 |

31.3 |

16.9 |

2.4 |

1.7 |

8 |

|

Time taken to deliver baggage |

41.2 |

34.7 |

9.2 |

2.7 |

2.5 |

7.5 |

|

Seat Comfort/ Leg room |

18.2 |

38.6 |

34.1 |

1.9 |

1.6 |

5.6 |

|

Overall experience |

38.8 |

39.1 |

12.6 |

1.7 |

1.7 |

6.6 |

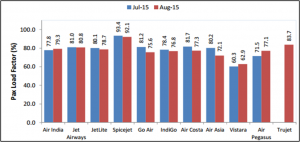

Passenger load factors of various scheduled domestic airlines in August 2015

Source: www.dgca.nic.in/

Over the Top Liberal Dividend Distribution Policy in light of Debt & Expansion Plans

The Company’s Networth as of June 2015 has turned negative Rs 139.9 Crs from Rs 426.22 Crs in March 2015 as the Board of Directors depleted the Airline’s Reserves completely by rewarding a huge Interim Dividend of Rs 1003 crs in Q 1 FY 16.

FY 15 saw the declaration and payment of four interim dividends aggregating Rs 1079.67 Crs while FY 14 saw a total of Rs 377.58 Crs as dividend. Out of the combined dividend of FY 15 and Q1 FY 16 , the Promoter Families of Gangwal & Bhatia received Rs 960 Crs & Rs 970 Crs respectively.

The Company has made over Rs 3273 Crs as PAT over the last five years and paid a staggering dividend of Rs 2497 Crs over the same period amounting to a dividend payout of a whopping 76% in aggregate for last 5 years.What was yet remaining it paid out in Q 1 FY 16 when it’s payout was Rs 1003 crs or 157% of the PAT of Rs 640 crs for the quarter !

It has a total debt of @ Rs 3500 Crs which is primarily for the Plane Acqusitions through Operating & Financing Leases.Of the 97 plane fleet currently,75 are on Operating Lease while 22 are on Finance Lease

A question does come to mind ~ With an upcoming IPO why could the Promoters have not reduced Debt significantly instead of rewarding themselves with a Huge Interim Dividend of over Rs 1000 crs in Q 1 FY 16 ! which took IndiGo into negative Networth ! ? .

Of course they knew exactly what they were doing and we hope it is not linked to the fantastic FPI response to the IPO !!!

In light of Expansion Plans and Orders of 430 Airbus placed is this a prudent and wise Distribution Policy of emptying full coffers of the Airline before the IPO ? What arrogant message does it send ?

Each Airbus cost @ US $ 97 Million or @ Rs 6300 crs ….so what if it’s a sale-lease back financing structure ! Is not the sole chief object of the IPO to apply Rs 1165 crs or 91.5% of the Rs 1272 crs being freshly raised in the IPO to repay lease liabilities and for subsequent acquisition of aircraft !

“We have conviction in IndiGo — investors have to make up their minds,” says Promoter Gangwal, adding that if it hadn’t been listed, “we would keep on declaring these dividends” in one of his pre IPO interviews.

Indigo had @ Rs 3675 crs in Cash defends the promoters when making the Dividend payment in Q 1 FY 16.True but what was the nature of this cash ! The promoters claim that the aircraft carrier has been able to meet all working capital requirements through the cash generated from operations and has not taken any working capital loans to finance various regular expenses such as employees’ salaries, aircraft fuel, aircraft rentals and charges.

So what did this Cash really probably represent !? Part of Sales!? Yes,but it is interesting to note that the Company receives non-refundable incentives from Airbus. The application of these credits to its operating leases results in a net reduction in aircraft rental payments which is amortized over the initial terms of the operating leases. As of June 30, 2015, the Company had unamortized deferred incentives of Rs 1646.67 Crs as a result of these credits.

WHY ARE PROMOTERS PERCEIVED TO BE GREEDY ?

The Promoters’ Greed Perception has been conceived pre IPO for three clear reasons

- 1. Rewarding themselves with Huge Dividends to take the Airline into Negative Networth as of June 30,2015.IndoGo earned Rs 3913 crs from FY 11 to Q 1 FY 16 of which 89% => Rs 3500 crs has been taken away by Dividend

- 2. Rewarding themselves with a very liberal 9:1 Bonus pre IPO

- 3. Structuring the IPO with nearly 60% of the Issue Size of Rs 3018 crs at top band pricing of Rs 765 through Offer For Sale in which all of them are participating and Promoters will receive @ Rs 970 crs or 55% of the OFS for Rs 1744 crs

High Premium in IPO Pricing Band of Rs 700- Rs 765 is being demanded for a Promising Present & Future based on a Profitable Past which may or may not sustain into the Future if Aviation Turbine Fuel Prices which have halves begin to rise again.Just because IndiGo may earn in FY 16 as much as it has earned in the last five years put together is not enough justification for the IPO Pricing

This seems to be the justified Emotional Grouse of many Analysts and Retail Investors in particular but clearly not the FPIs who have lend it fantastic support.Do we interpret this as FPIs investing without a conscience or care for what can be perceived a s Corporate Governance Concern ! ?

IPO Pricing Justification

Assuming IndiGo makes a profit of Rs 2500 Crs for FY 16 and considering the post-Issue equity of Rs 360.35 Crs, the net worth of the Company jumps to Rs 2600+ Crs. That gives a BV of Rs 72+ & a P/BV of 10.5+ and an EPS of Rs 69 per share and a PE of 11 at the upper end Rs 765 per share.

At Rs 765 Indigo would be valued @ Rs 27000 crs or over US $ 4 Billion,ranking it No 22 Globally by Market Cap .Listed Jet Airways at Rs 405 has a market cap of Rs 4600 crs while Spicejet at Rs 43 has a Market Cap of Rs 2600 crs

Going Forward if ATF prices remain low with Oil under US $ 50/barrel and with the huge Expansion Plans underway in IndiGo,the Future Profitability & Growth is assured

And if Dividend Distribution Policy is maintained as liberal in the future as in the past by Promoters,it would mean Payout % of 70% of Profits => Translates to Dividend of near 600% or Rs 60 on PAT of Rs 3000 crs and a dividend yield of over 7.5% on a Price of Rs 765 !

IPO Subscription

43 Anchor Investors,both FPIs and DIIs have already lapped up Rs 832 crs in the QIB Portion which had already crossed 5 times subscription till yesterday evening.Thus the Issue has already been fully subscribed and closes today.However there is muted response yet in all other categories.However even the recent IPO of Rs 1150 crs of Coffee Day Enterprises at Rs 328 saw QIB segment oversubscribed 4.38 times while both NII & RII segments were undersubscribed .Listing is awaited eagerly

Positives:

- Low Aircraft Penetration Rates ~ India has one of the lowest air travel penetration rates in the world. Penetration level in India stands at 0.08 annual domestic seats per capita whereas that of US is at 2.3 and between 0.35 to 0.65 for countries such as Russia, Brazil, China and Turkey.

- Market share based on capacity ~ IndiGo’s domestic ASKs have increased from 5.3 billion in FY2008 to 31.4 billion in FY2015, growing at a CAGR of 28.9% over the same period, while all other Indian carriers collectively declined at a CAGR of 0.5% over the same period, according to DGCA data

Average Seat Km ~ Amt in US cents

|

Indigo |

5.59 |

|

GoAir |

6.37 |

|

SpiceJet |

6.68 |

|

Jet Airways |

9.05 |

|

Air India |

9.82 |

- Average fleet age ~ Indigo had the second youngest average fleet age of 3.1 years, followed by GoAir at 3.6 years, SpiceJet at 3.8 years, Jet Airways at 5.8 years, and Air India at 10.3 years, as of December 31, 2014, respectively, according to the CAPA report. As of now, for Indigo the average age of fleet is 3.84 years. The lower the average fleet age, higher is the fuel utilisation efficiency. Indigo maintains its young fleet by predominantly entering into short-term sale and leaseback operating leases for the aircraft ordered from Airbus, typically ranging from three to six years. It runs on policy of six years operating lease in which it returns aircraft to lessor after six years and replaces it with a new one.

- Unit costs ~ Indigo has the lowest cost per available seat kilometre (CASK) of all Indian carriers and amongst one of the lowest CASK excluding fuel expenses compared with publicly-listed LCCs globally. The CASK of IndiGo for FY2014 was US cents 5.95, US cents 6.37 for GoAir, US cents 6.68 for SpiceJet, US cents 9.05 for Jet Airways and US cents 9.82 for Air India.

- Revenue per available seat kilometre (RASK) is a measurement of unit revenue while RASK minus CASK, is a measure of a carrier’s unit profitability. Excluding fuel cost from the analysis provides an indicator of a carrier’s unit profitability before taking in to account fuel costs. IndiGo’s RASK minus CASK excluding fuel was the highest in India and higher than all of the LCCs operating in Asia.

- Ancillary Revenues ~ The airline is also focusing on ancillary revenues, which account for 11% of total revenues

- Aviation Turbines Fuel prices ~ Crude oil prices have been hovering around US $ 50. The sharp drop in prices has given the airlines the flexibility to drop ticket prices. This has helped improve volumes. Passenger volume growth in the five months (April to August) of FY16 has been a strong 21 per cent year-on-year.

Some Risks

- Depreciation of the Rupee ~ Expenses such as aircraft orders with Airbus, aircraft and engine leases and financing payments, aircraft fuel are denominated in U.S. Dollar while Revenues are predominantly in Indian Rupees.

- IndiGo recorded a Negative Networth as on June 30,2015 on account of being depleted of Reserves by a huge Interim Dividend of Rs 1003 crs in Q 1 FY 16.Future Profitability may revert to lower than the Record FY 16 ongoing year especially if the Price of Aviation Turbine Fuel begins to rise again after it halved on Oil Prices halving from US $ 100+/barrel to US $ 50/barrel

- IndiGo has been unable to honour it’s aircraft purchase commitments in the past from Airbus.It may face similar problems in the future which will affect it’s expansion and growth plans.Moreover it may not continue to receive non-refundable incentives from aircraft manufacturers in the future.It had over Rs 1600 crs of such incentives as on June 30,2015

CONCLUSION

We have opined right at the start to FLY INDIGO !

The past Aviation Turbulence that led to the debacle of Kingfisher Airlines & to Negative Networths of listed Companies Jet Airways & Spicejet of course do tend to be right upfront when arguing against applying in IndiGo at High IPO Price Band of Rs 700 to Rs 765.The Promoters Greed as perceived and outlined above also adds to the negatives

Yet the Low Cost LCC Business Model that has given profits in 7 of the 9 operating years + Projected FY 16 PE of 11 on Record FY 16 Bottomline expected of at least Rs 2500 crs & Promise of a Record FY 17 too as ATF Prices should remain low + the attraction of a promising Dividend Yield even at Rs 765 + the Huge Expansion Plans to increase Fleet Size from current 97 Airbus to 527 over the coming decade to tap scale potential in India tilts the favour into taking the risk to apply in the IPO at even Rs 765

Of Course if the Dividend Policy remains as liberal post IPO as it has been Pre IPO it would mean less Retained Profits and that would mean a lesser Book Value…not really prudent going forward

If you skip the IPO,do keep a watch on listing and subsequent Price Movements