@ 2200 Million Dollars In & our Sensex 2200 Points up in just over the first month in Calendar 2012!

December 2011 closed at 15500 Sensex levels…Then came some frenzied FII Inflows of @ US $ 2200 Million in January and the first week of February in 2012 propelling our Sensex up 2200 Points and 14% to current levels of 17700 !

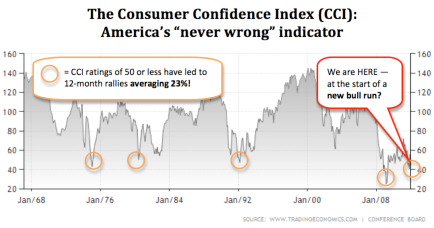

Nows comes a US Dow Posturing,and I must say rather pugnaciously too, by Alpha Chaser,Nicholas Vardy,of a level over 15000 by December 2012 !…it currently has surged to 12900 levels ….his dependency is on the indicator of Consumer Confidence Index

http://www.conference-board.org/data/consumerconfidence.cfm

When it falls below 50,a new bull run is indicated as a trend reversal…in October 2011 it fell below 40 after climbing back past 50 from all time low of just over 25 in March 2009…It closed January 2012 at 61.1 down from December 2011’s 64+ ….Look at the chart above…it shows that in the 44 year history of CCI,there have been 18 occasions when the Index dropped below 50…the five major spikes have been in 1974 (Oil Crisis),1980 (Iran Hostage Crisis,Rising Unemployment and Interest rates and 13.5% Inflation and a full recession in 1981/82),1991/92 (Post Gulf War Crisis,Growing deficits,Slowing GDP,Savings & Loans Crisis) and late 2011

So if The Dow Prognosis of 15000+ is Correct will we see even our Own Sensex racing past 20000 yet again by year end !?

Goldman Sachs have just issued a Buy on Reliance with a year end target of Rs 970 on an EPS of 90 for FY 13 …they are betting on better Refining Margins oin the second half of the current year and better demand,coupled with the fact of ‘mothballing’ of capacities and projects in USA and Europe

Reliance is currently just a shade below Rs 850 and has a beta of 1.18 and Sensex weightage of 10.31%…in the past there was allround perception that the Sensex Movement was directly corelated to that of Reliance…2009 and 2010 shattered this Myth…Reliance actually tanked,while Sensex soared back from 8000 levels to recapture 20000 Levels

Interresting Year…this 2012…End Feb,it should finally be a Make or Break for Greece as Euro Leaders finally decide to provide a Debt Relief package for Greece if it complies with stringent austerity measures or simply let it default…default increases the probability and possibility of Greece exiting the Euro Zone !…it’s a disastrous thought as hyper recession will set in Europe and major Financial bankrupties will occur…the implications are ominous to the rest of the World

So I am yet holding back from even a modest statement like 2012 may surprise you on the upside !

I remain a die hard Optimist covered currently by the reality of a Macro Pessimistic Blanket in this abnormally freezing Mumbai Weather (a shivering 8.8 C yesterday)

Cheers !