At the outset let me state I’m neither a hater nor baiter of Reliance Industries and it’s Ambani Family Promoters…on the contrary had applauded the late Founder Dhirubhai Ambani for his guts and gumption to create the Reliance Group in adverse,hostile and a monopolistic scenario where he broke down several barriers of entry to enrich millions of shareholders along with him right from 1970s and arguably making him the Father of the Equity Cult in India ….even today Reliance Industries has nearly Three Million Shareholders who keep the faith

However the debate is yet out whether Means justify the End or the End justifies the Means !

The near Three Million Shareholders must be aware of the Risks associated with a Reliance Investment….look at it as an opportunity cost for better returns in equity elsewhere

Sadly I had to remove Reliance Industries in 2012/13 as a Core Recommendation because of such Risks involved and Corporate Governance Issues as below….Though I do not hold any shares,many of my clients continue to do so and are part of the three million shareholders…I hold no emotional grievance or grudge for this continued holding but refrain from advising them on the Earnings Performance & Growth Plans and the possible impact on the Share Price and whether they should Buy or Hold or Sell…left it to them to decide

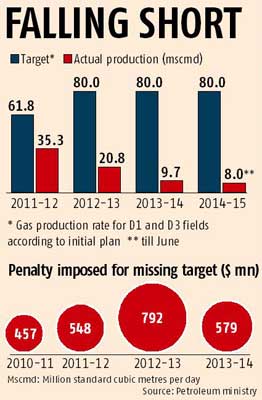

Reliance Penalised Again for KG Gas Underproduction ~ Pyrrhic Government Victory

Thus far the Penalties aggregate US $ 2.376 billion =>Rs 14256 crs at Rs 60=US$

Has Reliance got to actually pay these in Cash !?….. No

Reliance has gone in for arbitration for this

These are simply disallowed expenses and deducted from the Capex Expenditure & Investment Shown by Reliance and which has been cleared by the Directorate General of Hydrocarbons....the Director General from November 2004 to October 2009 was ex UPA & Congress Minister Mr Kapil Sibal’s Brother Mr VK Sibal….and it is interesting to note that when the Ambani Brothers were at each others throats in 2009 and 2010 after the Group was split, the younger Anil Ambani had openly accused his elder brother Mukesh Ambani’s Reliance Industries for hugely padding and gold-plating the Capex Spend for Clearance….he is known to have stated that the actual expenditure was just Rs 15000 crs but was shown as Rs 45000 crs and cleared in 2006 and the government stood to lose Rs 30000 crs in Gas Revenues !

….so these penalties simply reduce the Expenditure allowed to @ Rs 25000 crs…..the Directorate General began these penalties only last year in 2013 after gas production dropped below 30 mscmpd (equivalent to 180000 barrels of Oil per day)….the total investment is US $ 8.8 billion

So why is this Directorate clearance Investment Figure so important !?

Well it has to do with the Production Sharing Contract (PSC) that Reliance has signed with the Government

….in simple terms the Gas Resource is owned by the Government and Reliance is merely the Contractor awarded to explore the KG Basin and drill out the Gas……all such Gas Production has to be distributed as determined by the Government,largely to the main consumers,Fertiliser & Power Companies

….The Gas Price to is fixed for a period of Five years…for 2009 to April 2014 it was US $ 4.20/mBtu….and now has been doubled but the new price implementation has been deferred

…..Anil has accused Mukesh of gold plating to justify the Gas Pricing of US $ 4.20/mBtu and had urged the Court to make Reliance honour their contract with his RNRL to supply at US $ 2.34/mBtu.…he further accused Reliance of underproduction of gas as there was no demand at the time for gas at US $ 4.20/mBtu as global gas prices had plunged by 80%

…..the Government gets a part of the Revenue from Gas Sales only after Reliance recovers from the Revenues the Expenditure it has spend on the Gas Basin Infrastructure

….Reliance has also been accused of drawing Gas from area around it’s basin and ONGC has had the courage to file a case in the Delhi High Court against it’s major shareholder ~the Government and the Directorate General of Hydrocarbons for not doing enough to stop Reliance from doing so….ironically Reliance has approached ONGC for using some part of it’s Infrastructure in the KG Basin and pay a rental for it !…question is that if government is reimbursing such expenditure then it owns the Infrastructure too and thus ONGC should be able to use without any rental payment !…but ONGC is worried that while it may get a better gas price on one hand the government will also increase it’s contribution to subsidies which are inevitably going to rise for Power and Fertiliser Companies who will not be able to absorb the higher gas price…Reliance does not have to contribute to such subsidies

….and interesting to note how the string of UPA Government Petroleum Ministers acted or reacted in this situation

….Murli Deora thought Anil Ambani’s blast against Brother was just another tirade and he said the Government had cleared Rs 45000 crs KG Infrastructure Expenditure because Reliance had promised 80 mscmpd and though it had dropped to 30 mscmpd it would revive

…. Jaipal Reddy was replaced as Petroleum Minister after he slapped a US $ One Billion Penalty on Reliance or Gas Underproduction

…..Veerapan Moily wanted to investigate why ONGC filed a case for Gas Theft by Reliance !

Three other interesting but adverse scenarios for Reliance that have intensified in 2014 are :

- SAT rejects Reliance appeal against SEBI to allow consent term settlement for Insider Trading Charges

- CAG recommends DOT cancel the broadband spectrum for Reliance Jio for rigging the auction and violating rules

- Prashant Bhushan accuses Reliance & ICICI Bank for huge money laundering through Singapore and files a complaint with SIT for Investigation

Reliance Industries is currently below Rs 1000 at Rs 970 just before closing today,Tuesday,July 15,2014….52 Week High was in Mid May at Rs 1142 (16/5/2014) and Low was end August 2013 at Rs 765 (28/8/2013)

Though I’ve stated in the beginning I refrain from advising on Reliance,I must state this….my sense is that at least for the rest of 2014 it may remain (kept?) range bound at best and not seek it’s 52 Week Levels of sub Rs 800 though the roll out of Reliance Jio in 2014 and 2015 will be a game changer and better Gross Refining Margins and Scaling up Retail Business going forward may spell a better bottomline ahead…it has been able to maintain profitability at Rs 22000 crs levels in FY 14

Love or Hate Reliance but difficult to ignore it as it’s always in the News !